MoneyWorks Manual

Pricing and Terms

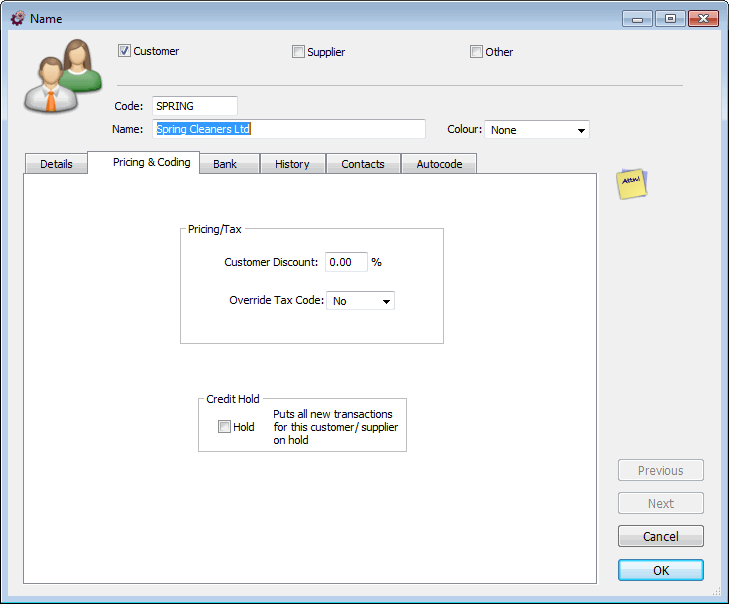

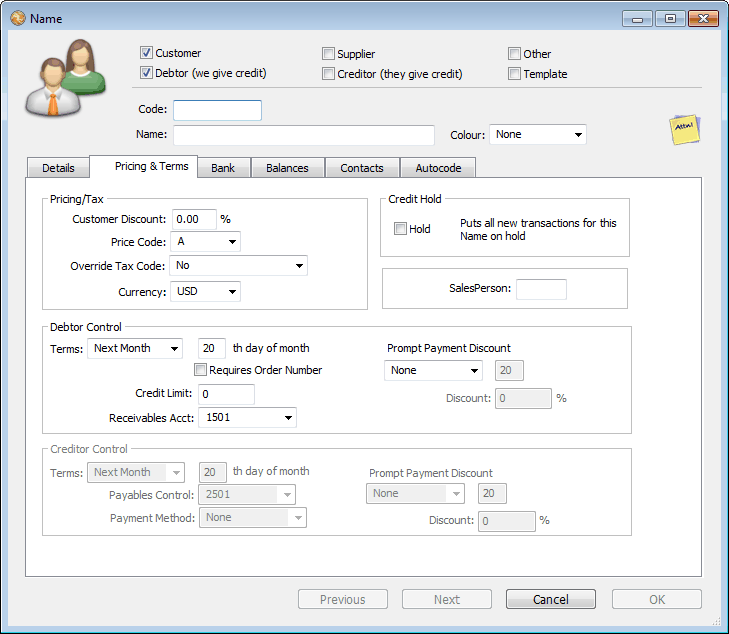

The Pricing and Terms tab is where you set the pricing for customers, and the details for debtors and creditors. In Cashbook it is called Pricing and Coding, and is used for specifying tax-overrides and default allocations.

Pricing and Coding (Cashbook)

Pricing and Terms (Express and Gold)

Customer Discount: The customer discount is an additional discount that the customer can use above and beyond that determined by the price code, for any product that has its discount field set to “Customer” or “Customer and Product” —see Sell Prices.

Price Code: Use the price code setting to determine the default product pricing level which the customer will attract —see Multiple Prices. This can be overridden at transaction entry time, and only applies if you have set up multiple prices.

Override Tax Code: In certain instances you might want to override the default tax code used in transaction entry (e.g. if the Customer/Supplier is located overseas there will probably be no GST/VAT or local Sales Tax). Set the pop-up menu to the Tax code you want applied to all transactions from the contact. Note that this does not override the * code, or the Tax on the Freight Code product of an order.

Currency: In MoneyWorks Gold, if you have defined more than one currency (see Multi-Currency), you will be able to specify the currency of the customer/supplier. All transactions for that customer/supplier will be deemed to be in that currency. Note that once the record has been saved, you will not be able to change this.

Requires Order Number: If set, you will not be able to enter a sales order/invoice from this customer unless there is a value in the order number field.

Debtor Terms: For debtors only, the terms that you are giving them. These are used to calculate the due date of invoices sent. The type of terms are set by the Terms pop-up menu, and can be either on a certain day of the following month, or within so many days. If the Overdue Warnings at Startup option is set in the Terms Preferences, you will be alerted when you start MoneyWorks if there are any overdue invoices.

Credit Limit: The amount of credit that you will extend to the debtor. A zero value represents unlimited credit. If the Auto Credit Hold option is set in the Terms Preferences, you will be alerted if the debtor exceeds the credit limit. If you don’t extend credit, make the Name a Customer and not a Debtor (which will limit transactions to cash ones).

Prompt Payment Discount: Use this to specify the prompt payment discount terms and percentage (if any) you are giving to this debtor. The discount is expressed as a percentage, and is applied to the transaction total based on the transaction date. It can expire on a given day of the following month, or last for the specified number of days. For details on receipting the discounts, see Prompt Payment Discounts.

Note: It is important that your prompt payments are correctly set up for your region. Please see the PPD preference settings.

Accounts Receivable Control Account: The general ledger account which will be debited whenever an invoice is raised against the debtor. You can create more than one control account if required, although one will suffice for most businesses.

Creditor Terms: For creditors only: the payment terms that you are given by the creditor. These are used to calculate the due date of invoices received, and operate in the same manner as debtor terms (see above).

Accounts Payable Control Account: The general ledger account which will be credited whenever an invoice is received from the creditor. You can create more than one control account if required, although one will suffice for most businesses.

Payment Method: The usual method by which you will pay the creditor. This is particularly useful if you are paying by direct credit through your bank’s on-line banking service —see Manual Electronic Payments.

Prompt Payment Discount: Use this to specify the prompt payment discount terms and percentage (if any) you have been offered by this supplier. The discount is expressed as a percentage, and is applied to the transaction total based on the transaction date. It can expire on a given day of the following month, or last for the specified number of days. For details on accepting the discount, see Paying Creditors Individually.

Note: It is important that your prompt payments are correctly set up for your region. Please see the PPD preference settings.

Hold: If the Hold checkbox is set, any transaction created against the Name will also have its Hold box set, so it cannot be posted. You can uncheck the hold box on the transaction if you do want to accept the transaction. This is a good way of giving discretionary control over whether you deal with certain contacts.