MoneyWorks Manual

PPD (Prompt Payment Discounts)

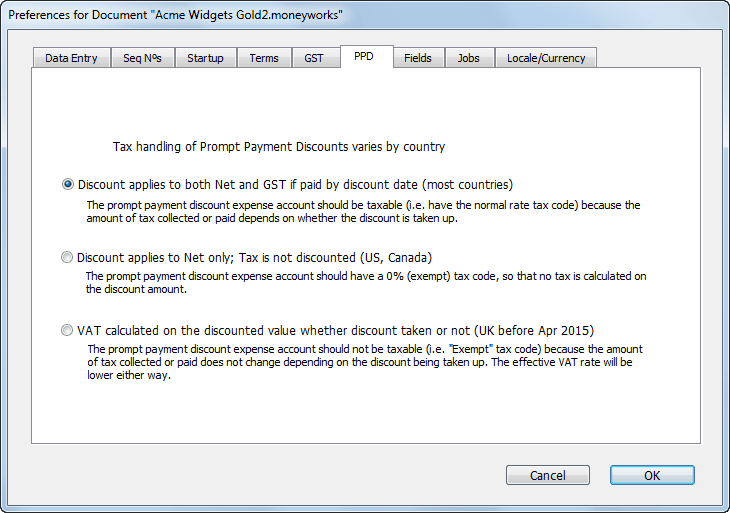

The handling of the prompt payment (or settlement) discounts differs by country. If you are giving or receiving prompt payment discounts, you need to ensure that it has been correctly set up for your local requirements.

When a prompt payment discount is taken, MoneyWorks creates a credit note to account for the discounted amount. This is coded to a nominated “Discounts” general ledger code. It is important that the GST/VAT/Tax code on this account has the appropriate GST/VAT/tax handling for your region.

Discount applies to both Net and GST if paid by discount date The case for most jurisdictions, the tax is a straight percentage of the amount paid, regardless of whether the prompt payment discount is taken up or not. The general ledger code should be taxable (see example 1a below), unless it is being treated in a similar manner to a finance charge (example 1b). If in doubt, you should check with your accountant.

Discount applies to Net only; Tax is not discounted For the USA and Canada, the tax is calculated on the full value of the invoice, and is not reduced by paying early. The Discount general ledger account should be exempt of tax (example 2).

Discount applies to both Net and VAT; VAT is always discounted This was the situation in the UK prior to April 2015. For the UK, the VAT is calculated on the discounted amount of the invoice, regardless of whether the discount is taken (which gives rise to some extremely weird arithmetic). The Discount general ledger account should be exempt of VAT (example 3).

To illustrate how the settings work, we will assume an invoice for $100 plus tax at 10%(i.e. a theoretical total of $110) with a 10% prompt discount rate.

| Example | Discount Taken | Discount Not Taken |

|---|---|---|

| 1a | Invoice Amt: $110 ($100 + $10 Tax) Amount to Pay: $99 ($90 + $9 Tax) Credit Note Raised: $10 + $1 Tax Total Tax: $9 | Invoice Amt: $110 ($100 + $10 Tax) Amount to Pay: $110 ($100 + $10 Tax) No credit note raised: Total Tax: $10 |

| 1b | Invoice Amt: $110 ($100 + $10 Tax) Amount to Pay: $99 ($89 + $10Tax) Credit Note Raised: $11 + $0 Tax Total Tax: $10 | Invoice Amt: $110 ($100 + $10 Tax) Amount to Pay: $110 ($100 + $10 Tax) No credit note raised: Total Tax: $10 |

| 2 (USA, Canada) | Invoice Amt: $110 ($100 + $10 Tax) Amount to Pay: $100 ($90 + $10) Credit Note Raised: $10 + $0 Tax Total Tax: $10 | Invoice Amt: $110 ($100 + $10 Tax) Amount to Pay: $110 ($100 + $10 Tax) No credit note raised: Total Tax: $10 |

| 3 (UK) pre Apr 2015 | Invoice Amt:: £109 (£100 +£9 VAT) Amount to Pay: £99 (£90 + £9 VAT) Credit Note Raised: £10 + £0 Tax Total Tax: £9 | Invoice Amt:: £109 (£100 +£9 VAT) Amount to Pay: £109 (£100 + £9 VAT) No credit note raised Total Tax: £9 |