MoneyWorks Manual

Special debtor/creditor code

The Postponed VAT will be recorded in an invoice (in fact two invoices—we shouldn't do things by half) to HMRC, so we need an appropriate debtor and creditor.

Note: You can also record the Postponed VAT as a payment/receipt. You will need to do this if you are using MoneyWorks Cashbook, as this doesn't have invoices. However an invoice seems tidier.

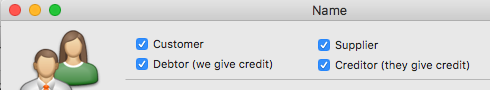

If you already have HMRC set up as a customer/supplier, check in your Names list (Show>Names) that they are set up as both a Creditor and a Debtor:

If they are not set up as both a Debtor and Debtor, you will need to change them (single user mode is required for Datacentre users).

If HMRC is not already set up, you will need to create them:

- Choose Show>Names

The Names list window will be displayed.

- Click the New toolbar button

The Name entry window will be displayed.

- Enter a Code ("HMRC" or "HMRC-PVA" spring to mind), and a Name

- Turn on both the Debtor (we give credit) and the Creditor (they give credit) check boxes, and click OK