MoneyWorks Manual

Recording your Postponed VAT

To record your Postponed VAT two transactions are required, a purchase invoice (or payment) to record the nominal VAT asset, and a sales invoice (or receipt) to record the nominal VAT liability. These will exactly cancel each other out.

Note: MoneyWorks determines the nature of the VAT by the transaction type. Don't try and be clever by reducing this to a single transaction.

To record the VAT liability we make a new purchase invoice to HMRC:

- Choose Show>Transactions, click on the Purchase Invoices sidebar tab then click the New button

A new purchase invoice entry screen will be displayed.

Alternatively make a new Payment if you aren't using invoices.

- Enter your HMRC name code in the Creditor field, check the date is correct, and enter a description such as "Postponed VAT"

- Leave the Amount as zero, and if necessary set the transaction type to By Account

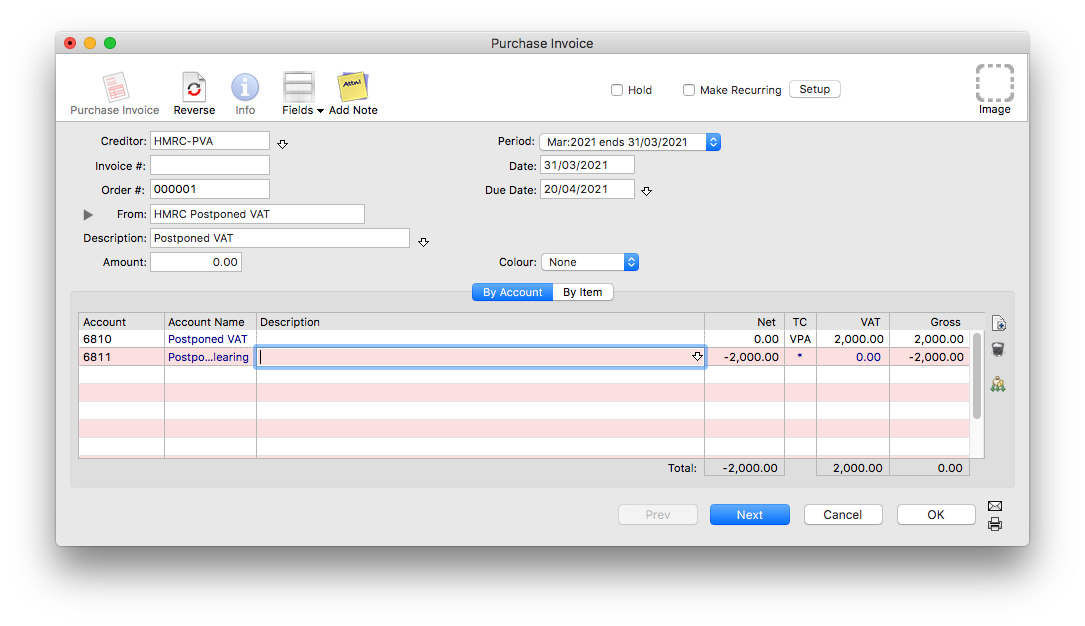

- Enter your Postponed VAT GL code (created above) in the Account field

- Enter the amount of Postponed VAT from your postponed VAT statement into the Net field

When you tab out of the Net, the amount should transfer automatically into the VAT field, with the Net becoming zero. If it does not then either you have used the wrong GL code, the GL Code doesn't have the tax code "VPA", or the "VPA" code has not been set to 100%. You should cancel out of the transaction and fix the error and try again.

- Tab through fields until you are in the Account field of the next line

- Enter the code for the Postponed VAT Clearing account, as created above.

- Depending on your Document Preference Settings, this line might self balance forcing the transaction to have a zero balance. If it doesn't, enter the negative of the Postponed VAT amount into the Net field

- Check that the tax code on this line is "*" and the VAT amount is zero

The transaction should look something like the following:

- Check the amount, date and coding and post the transaction.

Tip: As you are required to keep copies of the Postponed VAT Statements from HMRC, you should store the statement (which is supplied as a PDF) as an attached image on this transaction.

Now repeat the process, but this time make a Sales Invoice (or receipt). The date and coding on this transaction must be identical to that on the original Purchase Invoice (or payment).

Note: If you are using a Payment/Receipt you can opt to omit the second clearing line on each transaction as the payment and receipt will cancel out if done properly (but will still appear on your bank reconciliation, so should be marked off together). Any local currency bank account can be used, provided it is not an "Unbanked" account.