MoneyWorks Manual

Special General Ledger Codes

You will need a general ledger account to handle the postponed VAT. If you are processing your postponed VAT correctly this should always have a value of zero. To make the account:

- Choose Show>Accounts

The Accounts list window will be displayed.

- Click the New toolbar button

The account entry window will be displayed.

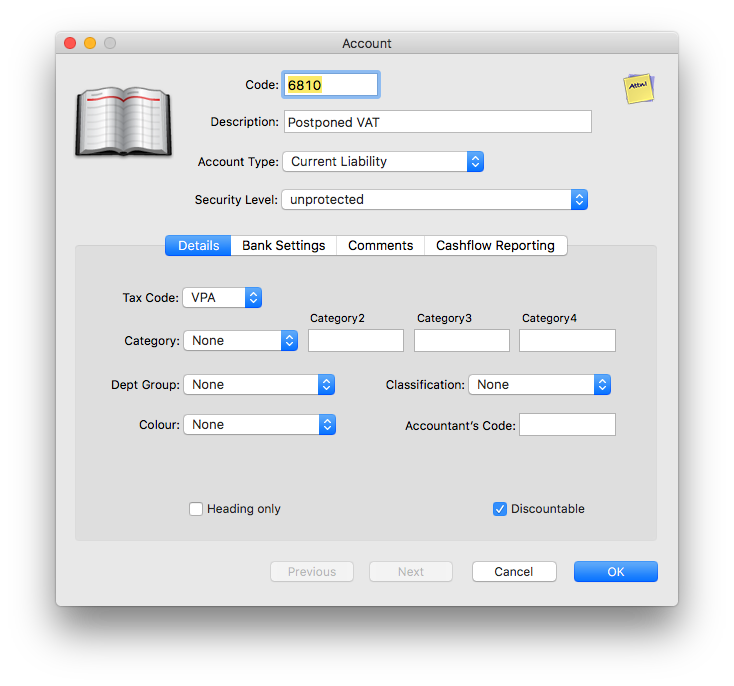

- Enter an account code for the new account and give it a description of "Postponed VAT"

For convenience it would pay to have the code near the VAT Paid control (so give it the next code in sequence to that). In practice it doesn't matter what the code is (so "PVAT" or similar is fine).

- Set the Account Type to "Current Liability"

- Set the Tax Code to "VPA" (or whatever tax code you created above).

- Click OK to save the new account.

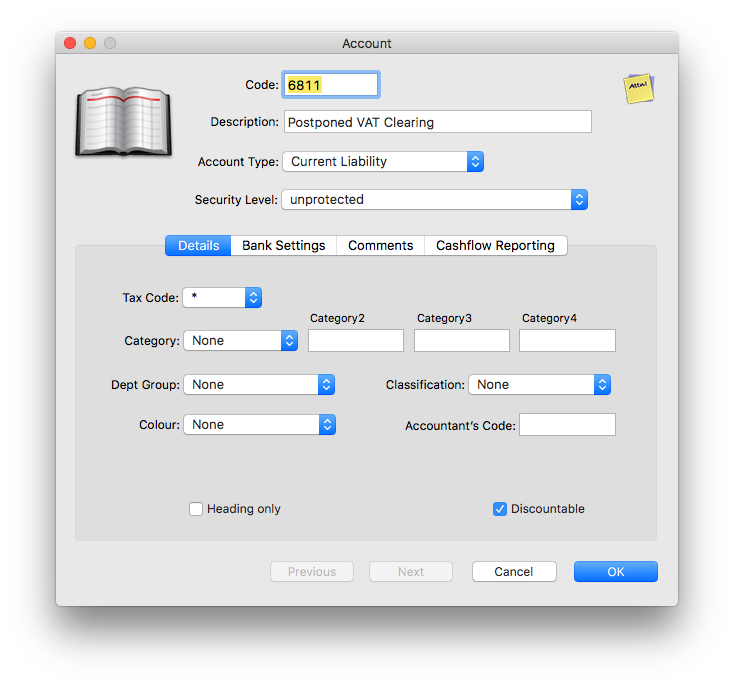

For convenience down the track, we are going to need a clearing or offset account. So create another new account similar to the above, but with a description "Postponed VAT Clearing" and, critically, a tax code of "*".