MoneyWorks Manual

Paying GST/VAT in Multiple Countries

Many countries have responded to the growth in on-line international sales by requiring vendors to collect GST/VAT on on-line sales and remit it to the relevant tax authorities. As of version 9.0.8, MoneyWorks Gold/Datacentre can manage your GST/VAT in multiple jurisdictions.

How it works:

- You must have Multi-Currency enabled;

- You create one or more tax codes specifically for that country to use with sales and purchases for that country;

- If MoneyWorks has a tax guide or on-line filing for that country, you map your code onto the equivalent standard MoneyWorks tax code for that country (for a list of standard tax codes, see Tax Codes);

- You use the Audit>Tax by Currency report to summarise your taxes over the required time interval;

- Where available, the tax guide and hence on-line filing can then be directly accessed from the bottom of the report;

- To use on-line filing in a different jurisdiction you must first run the appropriate tax guide which is where your tax number for that jurisdiction is entered.

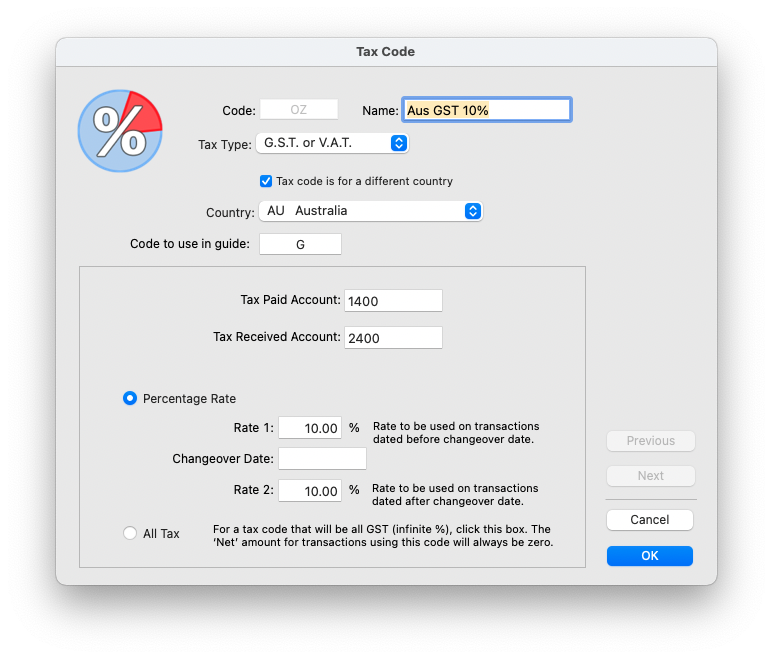

As an example, let us suppose that you based in New Zealand (and hence paying New Zealand GST), but you sell into Australia and have to pay GST on Australian sales. You would set up a new tax code (say "OZ") for the standard GST Australian rate:

Note that the tax code is set for use in Australia, and maps onto the standard "G" tax code used in the Australian GST Guide. Similarly you might set up an "OZF" account of zero percent GST mapping to the standard Australian "F" code.

Tip: It might pay to set up separate Tax Paid and Tax Received control accounts for each foreign jurisdiction. See Creating a New Account, and ensure that you set the Account Type to "GST/VAT Received" or "GST/VAT Paid" as appropriate.

For Australian customers (and suppliers) you would set up the Tax Override to "OZ" (and presumably the currency to "AUD").