MoneyWorks Manual

Bank to Bank Transfers

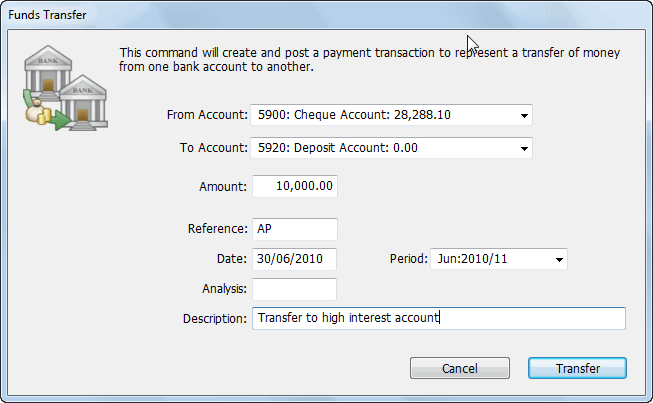

If you have more than one bank account, you may need to transfer funds from one to the other. You can accomplish this by a single payment transaction, which will credit the source bank and debit the destination bank1. However it is easier to use the Transfer Funds command

- Choose Command>Transfer Funds

The Funds Transfer window will be displayed.

- Set the From and To bank accounts, and specify the amount, date, period and description

- Click Transfer

A payment transaction will be created (and posted) from the source bank account to the destination.

Note that, if the currencies differ, you will be able to specify the exchange rate see [Transferring funds to/from a foreign bank account].

1 When the bank processes this transaction they will do the opposite, debit the source account and credit the destination account. When you deposit money with the bank, it a liability for them, so they record it as a credit. However it is an asset for you, so you record it as a debit. Confused? That’s why we have accountants. ↩