MoneyWorks Manual

Posting stock transactions without Enable Job Costing & Time Billing

When you post a transaction involving a product that you stock:

- The stock level is adjusted by the quantity in the transaction. If you are buying the product, the stock adjustment is the buy quantity multiplied by the conversion factor (since stock on hand is maintained in sell units).

- When you purchase stock items, they are treated as assets (they will be stored somewhere until used). Their value will not be expensed until they are sold. The stock account will increase (be debited) by the price of the stock items, and the stock quantity will increase by the quantity purchased multiplied1 by the conversion factor. The average price of the item will be recalculated.

- If you purchase a stock item whose current inventory level is less than zero, and the cost of that item is different to the nominal cost of the items in negative stock, MoneyWorks will automatically adjust the stock values to account for the discrepancy.

- Selling transactions involving stock items will generate additional accounting entries within MoneyWorks. Specifically when you sell an item your income increases, and so does your bank or accounts receivable account (in accounting terms, your income account is credited and your bank account or accounts receivable is debited). However at the same time the value of your stock has been reduced, and the amount that you had invested in the asset (i.e. the item sitting on your shelves) can now be treated as an expense (in accounting terms, the stock account is credited and the cost of goods account is debited). Thus there are actually four components to this transaction, not the normal two. However you don’t need to worry about this, as MoneyWorks will look after it for you—you can see the extra detail lines when you print a transaction listing with the Print Details toolbar icon. Selling stock items will also reduce the number of items in stock.

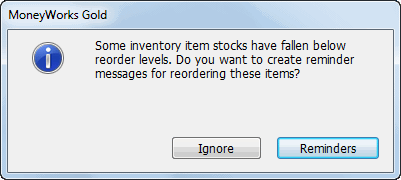

- If the stock level falls below the reorder point and the reorder warnings check box is set, a warning is given.

If you click the Reminders button, a message is created to remind you to reorder the product. These messages appear automatically when you open the file, or you can view them using the Show Today’s Messages command.

Warning: Never “sell” stock using a negative quantity on a creditor invoice (or payment). This will credit your stock account, and not your sales account. Also, unless the transaction sell value is the same as the average stock value, you will force your stock general ledger to be out of balance with the stock total as recorded in the product file. This does not apply to cancelled transactions, which MoneyWorks will handle correctly for you.

1 If you are importing or exporting product records, it is important to realise that MoneyWorks stores the reciprocal of the conversion that you entered. Technically the quantity purchased is divided by this stored conversion factor, which is the same as multiplying by the visible factor. ↩