MoneyWorks Manual

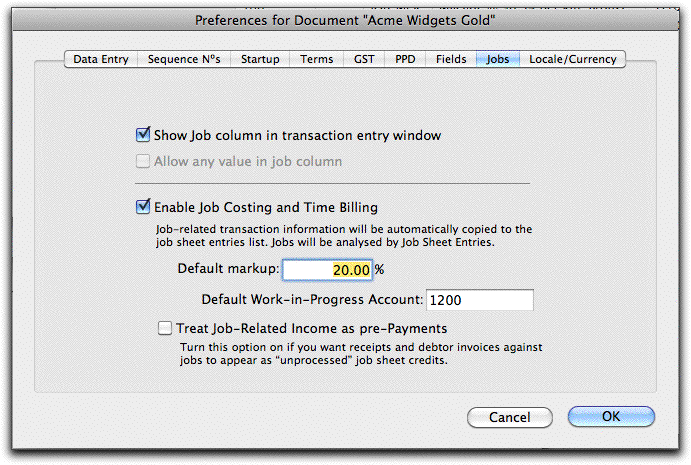

Job Preferences

Before you can start using jobs, it must be enabled in the Preferences.

- Choose Edit>Document Preferences

The preferences will be displayed.

- Click on the Jobs tab

The Job Control preferences will be displayed.

The job control preference options are:

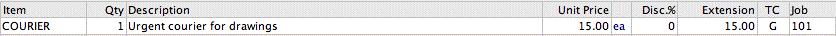

Show Job column in transaction entry window: If set, an additional column, the Job column, will be displayed in the detail line area of the transaction entry screen. This column can be used to enter a job code to tag that detail line as being associated with a job.

The additional job column will appear in all transactions except journals. It is not possible to associate a journal with a job.

You must set this option for job tagging.

Allow any value in job column: Normally when you type an entry into the job column of a transactions detail line MoneyWorks will check to see that the entry refers to a valid job. If the Allow any value in job column option is set, you will be able to type any value into the job column. This option and the Enable Job Costing and Time Billing option are mutually exclusive.

This option cannot be set if you want to do job tracking.

Enable Job Costing and Time Billing: With this option set, any transaction detail lines that are tagged to a job will be transferred to the Job Sheet file when the transaction is posted, thus automatically tracking direct costs associated with a job. In addition various job billing facilities become available.

Setting the Enable Job Costing and Time Billing option enables full job tracking.

Default Markup: The default percentage markup applied to the cost of items used in the job.

Default Work-in-Progress Account: Any work done on a job that can be (but which has not yet been) invoiced out is called work in progress. This is an asset for your organisation, because at some stage in the future it can be converted into cash.

As an asset, it can appear on the balance sheet, and you can transfer it there by using the Work-in-Progress Journal command. The default work in progress account is the default account code for new jobs.

Treat Job-Related Income as Pre-Payments Turning on this option will cause job related income transactions to be transferred as pending (instead of processed) job sheet items. Turn this on if you create invoices (or receipts) coded to the job before work on the job has been done (e.g. a deposit or pre-payment on a job), and this income needs to be offset against subsequent work.1

1 In MoneyWorks 6 and earlier this option was set in the Posting confirmation window. ↩