MoneyWorks Manual

Write Off Option

You can have MoneyWorks perform a write-off of an outstanding balance on a debtor invoice as you enter the receipt for that debtor. Use this feature if the debtor has overpaid or underpaid by some trivial amount that is not worth following up.

Let’s say you have a debtor with three outstanding invoices. You have received a cheque for one of these to the value of $450.00. The invoice was for 450.96. If you just enter 450.00 as the pay amount when you process this receipt, the invoice will not be considered to be fully paid. It will come up again next time you process a receipt for this debtor.

You have two options: You could follow up the underpayment with the debtor and demand the extra 96 cents. You would then process this 96 cent receipt in the normal way when you receive it and the invoice will thus be completed. Alternatively, you may want to forget about the 96 cents and just complete the (slightly underpaid) invoice now. MoneyWorks makes this easy.

Note: In MoneyWorks Gold, a Preference option allows you to limit the amount that can be written-off in this manner.

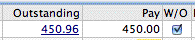

- In the Debtor Receipts dialog box, enter the amount received into the appropriate place in the pay column

In this case, the entry would be 450.00.

- Click the check box in the W/O column

W/O stands for Write Off. Clicking in this box tells MoneyWorks to consider the invoice completely paid.

When you complete the receipt or the batch of receipts, you will need to enter the Write-off Account code

For a batch of receipts, MoneyWorks prompts you for bank and period information for the receipts as usual. In addition, you will be required to specify a Writeoff account. You should already have created a suitable account (usually an expense account) to account for writeoffs.

For a Receipt, you will be prompted for the Write-off account.

- Type the code of the writeoff account into the Writeoff A/c field

If you can’t remember the code just press tab, and MoneyWorks will bring up the Account Choices box for you to find the account code.

For each invoice whose remaining balance you have “Written-off”, MoneyWorks will create a credit note with the description “Write Off”. The credit note will credit the debtor’s Accounts Receivable control account and debit the nominated write off account by the amount written off. It will also include any adjustments that need to be made for GST.

Note: Only one write-off account can be specified per batch of debtor receipts processed. MoneyWorks will remember the writeoff account that you supply and enter it for you next time you use the Write Off feature.