Requirements

GST F5 report in MoneyWorks 8.1.2 or later

Setup

- Create a All GST tax code

- Create a GST tax code called CAG to be used with prescribed items for customer accounting

- Create a general ledger code called GST Adjustment, assign it to ALL tax code and create an item also called GST_ADJ and code the Purchase (tick We buy it) account to GST Adjustment general ledger

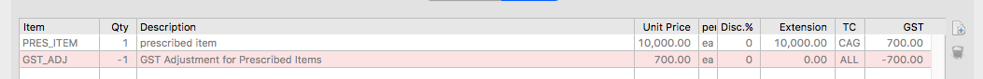

Data Entry – Creating purchase invoice or payment By Item

- Enter the prescribed item as normal (including tax etc) replace the tax code to CAG (instead of G)

- Enter another item called GST_ADJ (created during setup) the tax code will automatically be ALL.

- Enter the negative tax amount (from the Suppliers invoice) into the tax column

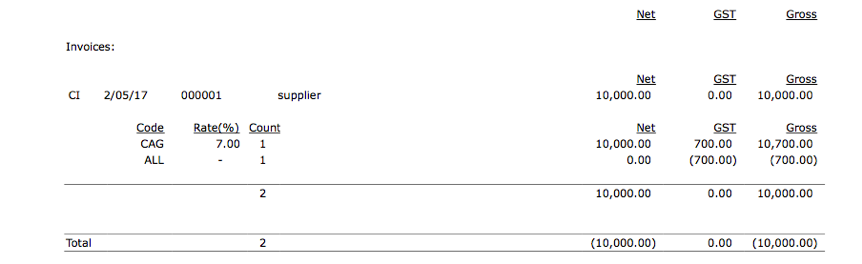

- The invoice will have the payable amount of $10000 (from the attached image), and tax adjustment for the prescribed item of $700 (which is to be reported by the customer on behalf of supplier)

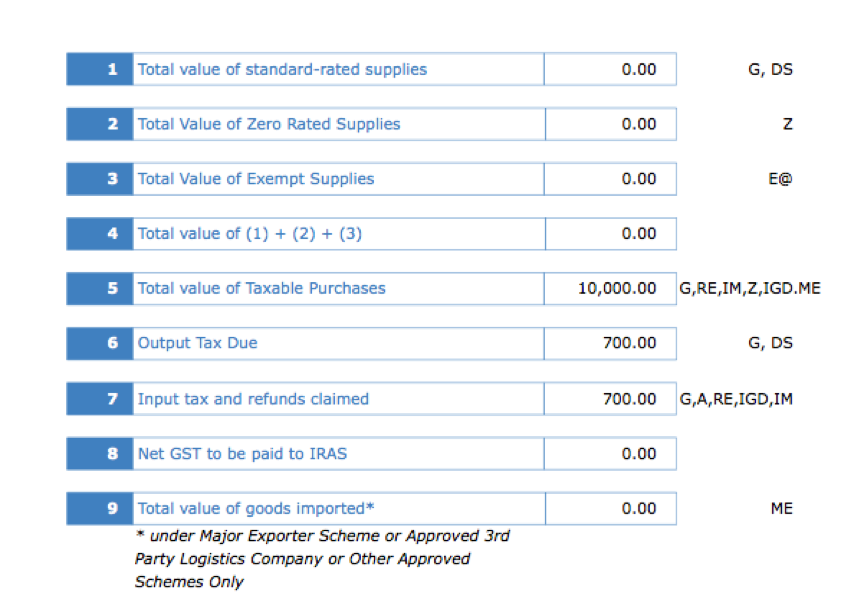

- Run GST report

- Run F5 Guide (updated)

- The net amount payable to IRD will be zero

If you are going to claim input tax on only the partial amount of the GST, then instead of -$700, you need to enter the amount you will be claiming back from IRAS, for eg. -$500 in the tax column of the invoice entry window.