MoneyWorks Manual

Buying Info

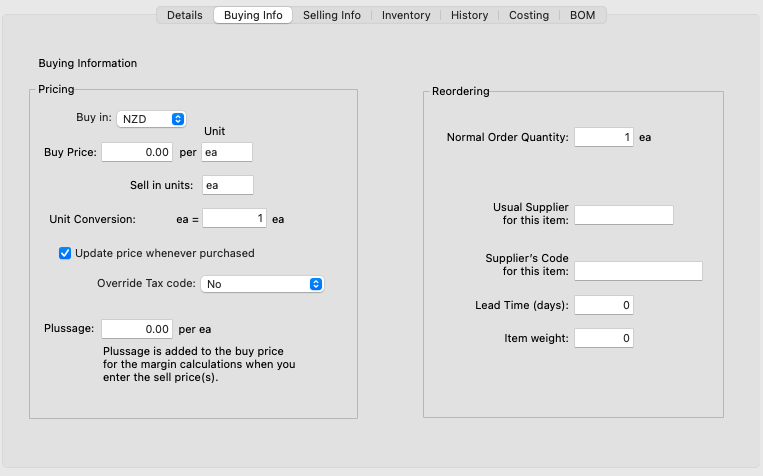

Information about the purchase of an item is specified in the buying info tab. This information includes the price and supplier details.

- Enter the normal purchase price into the Buy Price field

This is the amount for which you will normally purchase the item. It should not include freight, duties or other costs which are accounted for separately. It can have up to four decimal places.

Note: If you are using more than one currency, you can select the currency of the purchase price from the Buy in currency pop-up menu.

Note: Unless you have turned the Update Price Whenever Purchased option off, the buy price and currency will be automatically updated by the system to reflect the last undiscounted buy price whenever the item is purchased.

- Enter the purchase units (up to 3 characters)

The units might be “Kg” for kilogram, “ea” for each and so forth.

If you both buy and sell the item, the units in which you purchase may be different from the units in which you sell. You can use the conversion factor to convert the units from buying to selling. This will affect the margin calculation.

- Enter the sell units (up to 3 characters)

- Enter the conversion factor if required

This can have up to four decimal places. As an example, if you buy in kilograms and sell in grams, the conversion factor will be 1000 (i.e. the number of sell units that is a single buy unit yields).

Note: For inventoried products, the stock-on-hand is always recorded in selling units. This conversion will happen when you buy the stock.

Update Price Whenever Purchased: Turn this option off if you do not want the last buy price to be updated whenever you purchase this item.

Override Tax code: By default, when you purchase the item, the tax (GST/VAT etc) will be calculated based on the tax code associated with the general ledger code of the purchase account. You can force a different tax code by setting the tax override to a specific tax code. Note that this setting is subservient to any tax override associated with the supplier.

Plussage

The buy price represents your normal purchase price. However there may be additional costs, such as freight or labour, that you want included into your cost for calculating margins.

You can store this additional cost in the Plussage field. This is not an accounting cost (the actual charges will be accounted for elsewhere), but is added to your purchase price for the margin calculations when you enter the sell price(s).

- Enter the plussage amount (if any) into the Plussage field

This can be up to four decimal digits.

Reordering Details

If you buy the item, you can optionally record your main supplier and their product code if you want. This will appear on the reorder reminder message and is used in the Reorder Products command —see Batch Reordering. You can also access this information from the Report Writer and Forms Designer if you are designing a purchase order.

- Enter the Normal Order Qty

This is the number of the item that you would normally purchase.

- Enter the supplier code into the Usual Supplier field

The code must be that of an existing supplier.

- Enter the supplier’s product code into the Supplier’s Code field

This can be up to 19 characters long, and is the code that the supplier uses. You can use the “Lookup” function in the Forms Designer to find this code in purchase orders.

- Enter the normal lead time in days into the Lead Time field

Use this information to help you manage your stock ordering

- Enter the purchase weight of the item into the Item Weight

You can use this to calculate shipping weights on purchase orders. The actual units (kg, lbs, methuselahs1 etc) are up to you, but you should maintain consistency otherwise you will be adding methuselahs to jeroboams, which would put you in a right pickle.

1 Tip: If you are dropping off some of the liquid stuff to express your thanks for such a fine accounting system, a methuselah is better than a bottle, but a bottle is just dandy! ↩