MoneyWorks Manual

Importing the Chart of Accounts

You can import account information for your chart of accounts. This can be done either by importing the data from a text file, or by using the Paste command in the Edit menu if you have previously Copied the information onto the clipboard.

To import accounts:

- Choose File>Import>Accounts, or Choose Edit>Paste if you are pasting the data in from the clipboard

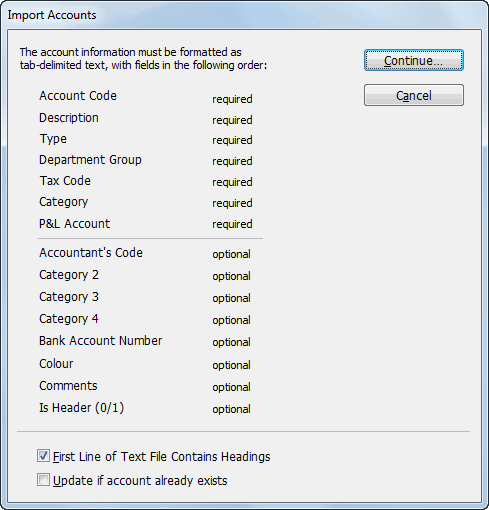

The Import Accounts window will be displayed.

This gives information on the structure of the file that can be imported. See Importing Chart of Accounts for details of this.

- If your file contains headings or other information in the first line, set the First Line of Text File Contains Headings option

When this is set any information in the first line is ignored.

- If you are updating information in an existing account, set the Update if account already exists option

If the account already exists in your system, it will be updated to reflect the information being imported. Only some fields can be updated.

- Click Continue

The Import Accounts window will close and be replaced by the standard file open dialog box.

- Highlight the file to import, and click Import

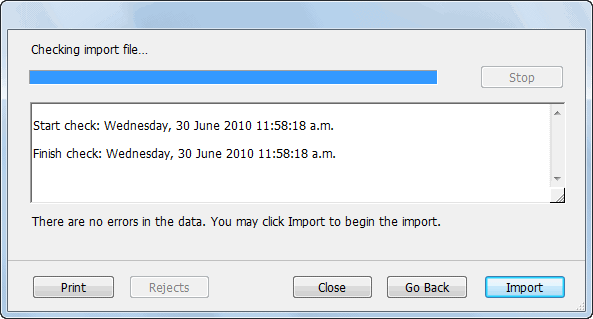

The import file checking window will be displayed.

If any errors are found in the file they will be listed here. You will need to correct these and repeat the import procedure.

- Click Import to import the accounts

The accounts will be imported and any necessary departments and categories created.

If Close is clicked no import is done.

Accounts File Format

The information required for importing is displayed in the table below. All items of information about the account must be supplied. These fields must appear in the order shown in the following table.

| Field | Description |

|---|---|

| Account Code | The code that identifies the account. If you wish MoneyWorks to departmentalise the account as it is imported, the whole line should be duplicated for each department, and the account codes should be suffixed by a hyphen and the department code (e.g. = "1000-XYZ= "). Accounts with a department code must have a department group code in the Department Group field. If the account code already exists, the entire line is ignored unless the Update if Account Already Exists option is set. |

| Description | The name of the account |

| Type | The type code for the account. This must be one of:IN, SA, EX, CS, CA, CL, FA, TL SF for Income, Sales, Expense, Cost of Sales, Current Asset, Current Liability, Fixed Asset, Term Liability and Shareholders Funds respectively; or: BK, AR, AP, GR, GP, PL for the system account types Bank Account, Accounts Receivable, Accounts Payable, GST Received, GST Paid and Profit & Loss. |

| Dept Group | The code of the department group if the account is to be departmentalised. |

| Tax Code | The tax code for the account. This must be one of the codes already present in the tax rates table. |

| Category | A category code. This can be a category that you have already created, or you can have MoneyWorks create the new category as the accounts are imported. |

| P&L Account | If the account is an income account or an expense account (it has = "IN= " or = "EX= " in the Type field), you need to specify which P&L account the income/expense account will be associated with. For accounts of other types, this field must be empty. |

| ... | The remaining fields are optional, and will be imported if they exist in the file. The position is important--if you want to import Category2 but not the Accountants Code, there needs to be an empty field where the Accountants code would be. You do not need to have the optional fields after the one you wish to import. |

Specifying the P&L account for IN, SA, CS and EX codes

The P&L Account specified for a new Income, Sales, Cost of Sales, or Expense account must already be present in the chart of accounts. If, in your text file, you use a P&L account code that is to be created by the import process, the account definition must appear in the import file before it is used in the P&L Account field of an Income or Expense account. A sample text file would be something like:

| Account | Description | Type | Group | TC | Category | P&L Acc |

|---|---|---|---|---|---|---|

| 900 | Profit and Loss | PL | * | |||

| 100-JF | Wages | EX | WAGES | E | FEXP | 900 |

| 100-DP | Wages | EX | WAGES | E | FEXP | 900 |

| 100-AB | Wages | EX | WAGES | E | FEXP | 900 |

| 110 | Stationery | EX | G | AEXP | 900 | |

| 120 | Telephone | EX | G | AEXP | 900 | |

| 150-WD | Sales | SA | PCENT | G | TINC | 900 |

| 150-GD | Sales | SA | PCENT | G | TINC | 900 |

| 400 | Cheque Account | BK | * | |||

| . | . | . |

In this example notice that the Profit and Loss account appears in the file before it is assigned to the expense and income codes 100, 110, 120 and 150. Notice also that the type codes used for the Profit and Loss account and the bank account are PL and BK respectively. After being imported, these accounts will appear in the accounts list with types SF and CA, since these are the general account types corresponding to those system account types.

When imported, MoneyWorks will create the department groups WAGES and PCENT. It will also create the departments JF, DP, AB, WD and GD. JF, DP and AB will be added to the group WAGES. WD and GD will be added to the group PCENT. The categories FEXP, AEXP and TINC will also be created. You will need to type in the descriptions for these — see Departments.