MoneyWorks Manual

The GST Report

The GST report prints a summary of the GST received and paid by you, broken down by the various tax codes, and is used to calculate your GST payment or refund. As such you must run it prior to making a return. The report is normally printed showing a list of transactions, providing a definitive reference as to how the GST was calculated.

To print the GST Report:

- Choose Reports>GST Report

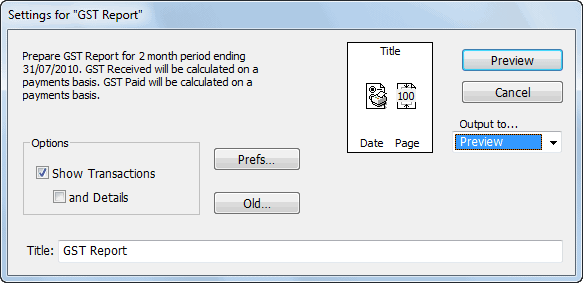

The GST Report setup dialog is displayed.

The information at the top left of the dialog box regarding the GST period dates and the basis for the GST calculations is taken from the Preferences — see GST/VAT/Tax.

- If the information at the top left is incorrect, click the Prefs button to change the preference settings

If Show Transactions is selected, each transaction that is included in the GST calculation is printed. You should print at least one copy of the report with this option set, as it will make the GST Audit trail clearer. If the option is not selected, a summary report is printed.

Note: The GST Report operates on posted transactions only—any transactions in the GST cycle must be posted before running this report.

If the and Details option is checked, MoneyWorks will also print details of each transaction detail line. As this may make the report very long, it is recommended that you only use this option if you are trying to locate a transaction whose GST amount appears to be wrong (e.g. a GST-Free transaction that has had GST applied to it1).

- Check that the Show Transactions option is on

This is how the report should normally be printed.

- Set the output to Printer and click Print

The GST Report will be printed. You will be asked if you want to finalise the GST report.

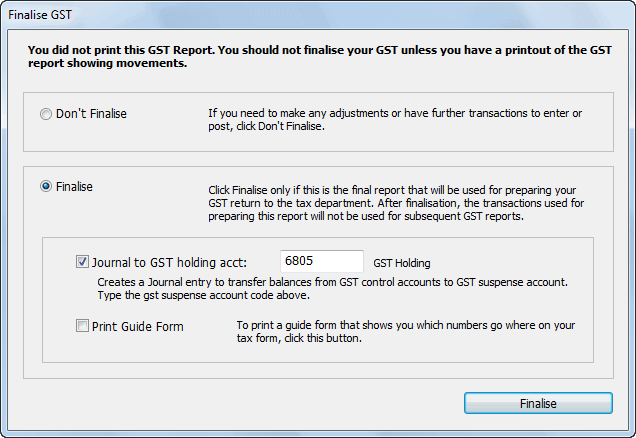

If you preview the report, the Finalise GST window will be displayed when you click the Close or Next button.

- When the report has successfully printed and you are happy that it is correct, click Finalise, otherwise click Don’t Finalise

Finalising the Return

Finalising updates the GST cycle and the also tags each transaction as having been processed so it won’t appear on the next GST report. Finalisation cannot be undone, so ensure that everything is correct before clicking Finalise. The numbers on the finalised report will be the ones that you transcribe to your return.

Note: For most printers, printing is done “in the background”, allowing you to continue to work on your computer while information is being printed. In this situation the GST Finalisation request will appear before the report is printed. You should wait until the complete report is successfully printed on the printer before clicking Finalise.

Set the Journal to GST Holding Account option on if you want to have the GST journal created and posted for you automatically (it will also be stamped as having been processed for GST in the current cycle). If you don’t create the journal, you will need to do it manually — see Journalling Out the GST Accounts.

Note: The first time you set this option you will need to specify the GST Holding account. It should normally be a Current Liability, with a tax code of “*”.

Set the Print Guide Form option on if you want to also print the GST guide form (this is disabled if there is no Guide form for your country). This will help you fill out your GST Return/BAS. You can print this later by choosing GST Guide Form from the Reports menu.

If you Forget to Finalise

It sometimes happens that people forget to finalise their GST report, and don’t discover this until some time later (normally when they come to prepare the next GST return).

Should this happen to you, the first thing to do is to redo the GST return to see if it has changed. Why would it have changed—simply because you may have backentered or corrected transactions in that (or a previous) GST cycle2.

So check that the totals on this are the same as the ones used on your last GST return. If they are the same, simply finalise the report.

If they are different, you will need to do a combined report for the previous and the current GST cycles, and subtract off the results that you used to make your previous GST return. To achieve this, set the GST Cycle date forward to the end of the current GST Cycle (by clicking the Prefs button in the GST Report Settings window), and print the report.