MoneyWorks Manual

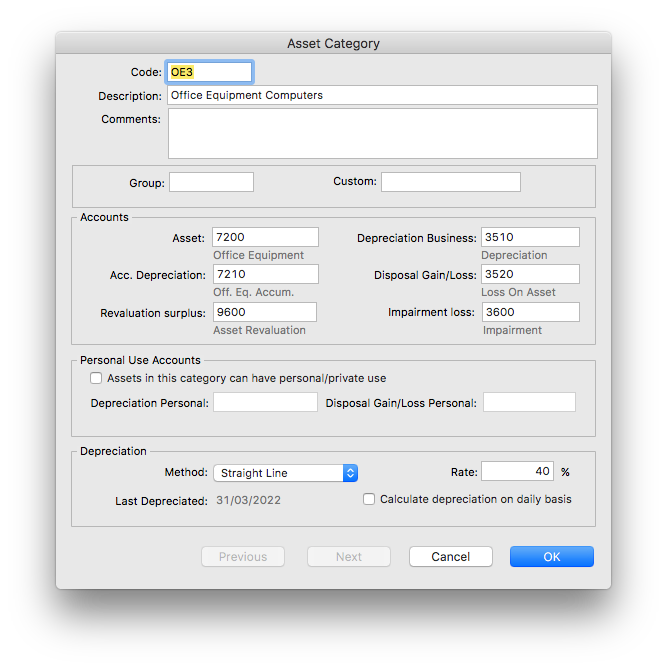

The Asset Category Window

In addition to grouping the assets for reporting purposes, the Category of an asset determines which general ledger codes are used for depreciation, accumulated depreciation, gain/loss on disposal etc. A newly created asset will inherit the depreciation type and the rate specified in the category as its default.

The Category fields are:

Code: A short code to reference the Category. This can be up to seven characters in length.

Description: A description (up to sixty characters) of the asset category.

Group: For your own use in grouping Categories, for example a standard industry code that might be used in your jurisdiction. The Asset Register report can be subtotalled by group.

Custom: For your own use.

Comments: Your comments on the category or its use.

General ledger codes: The general ledger codes to be used by MoneyWorks for handling depreciation etc on assets in this category.

| Ledger | Type | Ledger | Type |

|---|---|---|---|

| Asset | FA | Depreciation | EX |

| Accumulated Depreciation Business | FA | Depreciation Personal | EX |

| Revaluation Surplus Reserve | SF | Disposal Gain/Loss | IN or EX |

| Impairment Loss | EX | Disposal Gain/Loss Personal | IN or EX |

Note that, if the Depreciation expense account is departmentalised, individual assets that belong to the asset category can be assigned a department from the associated Department Group (this allows the depreciation expense to be assigned to a particular department or cost centre). The department is derived from the "Department" field on the asset record itself. If other accounts are departmentalised, then they should belong to a Department Group that contains the asset's department.

Personal Use Accounts: If assets in the group can be used for personal use, turn on the Assets in this category can have personal/private use check box. You will need to specify the depreciation expense and disposal gain/loss accounts to use for the personal proportion of the asset. The percent personal use is specified in each asset.

Depreciation Type: Two types are supported in MoneyWorks:

- Straight Line Method (SL), and

- Diminishing Value Method (DV).

Depreciation Rate: The applicable annual percent depreciation rate for this category of asset. Note that allowable depreciation rates and type will differ in each jurisdication. If in doubt, check with your accountant.

Last Depreciated: The date the category was last depreciated to.

Calculate depreciation on a daily basis: Turn this on if you want depreciation to be calculated for assets in this category based on the days in month (instead of strictly monthly). Some jurisdictions require this. If set, the monthly depreciation will be calculated as annual depreciation x days in the month ÷ days in year (so leap days are accounted for). Otherwise the monthly depreciation is one twelve of the annual depreciation

Note: Daily depreciation means that if your periods align to calendar months, the depreciation will be slightly different each period, but the annual depreciation will be the correct percentage. Similarly if you have custom periods (such as 4, 4, 5 week periods, or a special End period), the depreciation results will reflect the number of days in the periods being depreciated.

Caution: You cannot reset the Calculation depreciation on a daily basis option once you have started depreciating assets in that category (the results would not be pretty!).