MoneyWorks Manual

Asset Disposal and Write-offs

When an asset is disposed off, either by selling it or by writing it off, this needs to be recorded in MoneyWorks. Because asset disposal necessitates several accounting adjustments, assets must be disposed of as outlined below. Assets will continue to be depreciated until they are disposed. Note that only local currency can be used.

Note: In practice, the asset sale might already be recorded in MoneyWorks. In that case you would use the Journal option as the disposal transaction, and the contra account would be whatever was on the receipt/invoice recording the asset sale.

- Choose Show>Assets

The Asset list will be displayed.

- Highlight the asset being disposed of

Each asset must be disposed of individually.

- Click on Dispose toolbar button

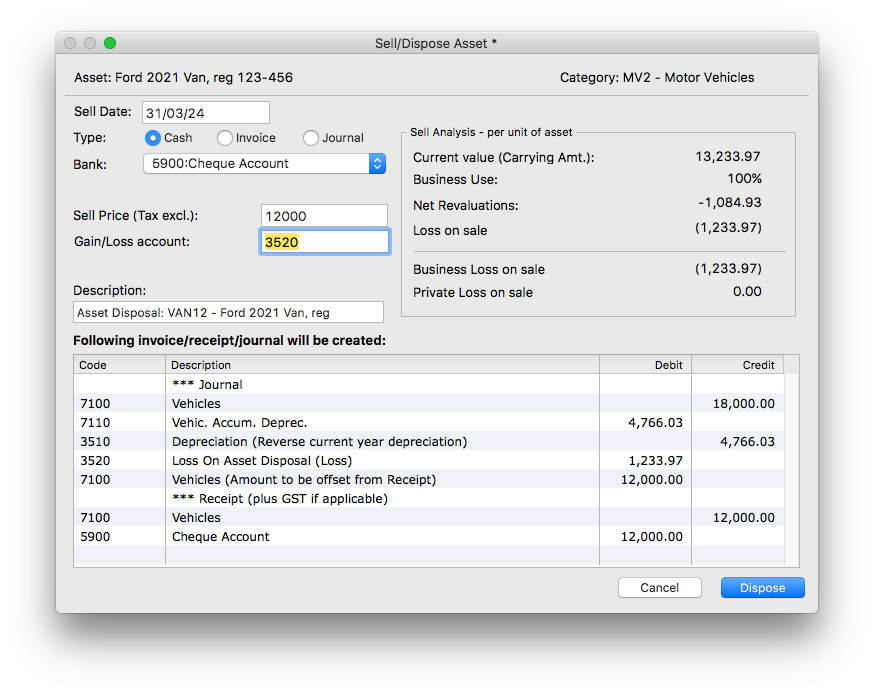

The Sell/Dispose Asset dialog will appear. This contains a sales analysis on the right, and the accounting transactions that will be generated at the bottom. These update automatically depending on the information that you enter.

- Enter the date of disposal

- Select the type of sale transaction

The sale can be made as a receipt (where you are receiving "cash"), as an invoice, or recorded as a journal. Depending on the type selected, you will need to select a destination bank account, specify a customer code, or specify a contra general ledger account for journals.

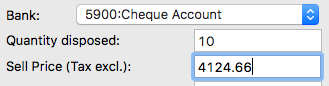

- If you are selling a group of assets (such as desks), enter the quantity being sold

- Enter the sell price of the asset

This is the total being received for the asset (or group of assets) and excludes tax. This defaults to the asset's current value. Set it to zero if you are writing off the asset.

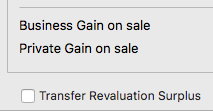

- Make sure that the general ledger codes for Gain/Loss account (and private) are correct.

These default to those specified in the associated asset category record.

If the asset has been revalued upward, you can choose to adjust the revaluation surplus account (this adjustment is put to retained earnings).

- Turn on the Transfer Revaluation Surplus checkbox to transfer any revaluation surplus

This only appears if the asset has been revalued and if there is a revaluation surplus. The journal display will adjust. Turning the checkbox off again will suppress the transfer.

- Click the Dispose button

The appropriate journal and sales transaction (if any) will be created, and the status of the asset will be set as being disposed. The sales transaction will appear in the History list of the asset.

Note: The sell price of the asset is taken as being tax exclusive. Any tax applied will be taken from the tax code of the associated fixed asset general ledger code, possibly overridden by the customer's tax settings for invoiced sales.