MoneyWorks Manual

Costs with Job Tracking

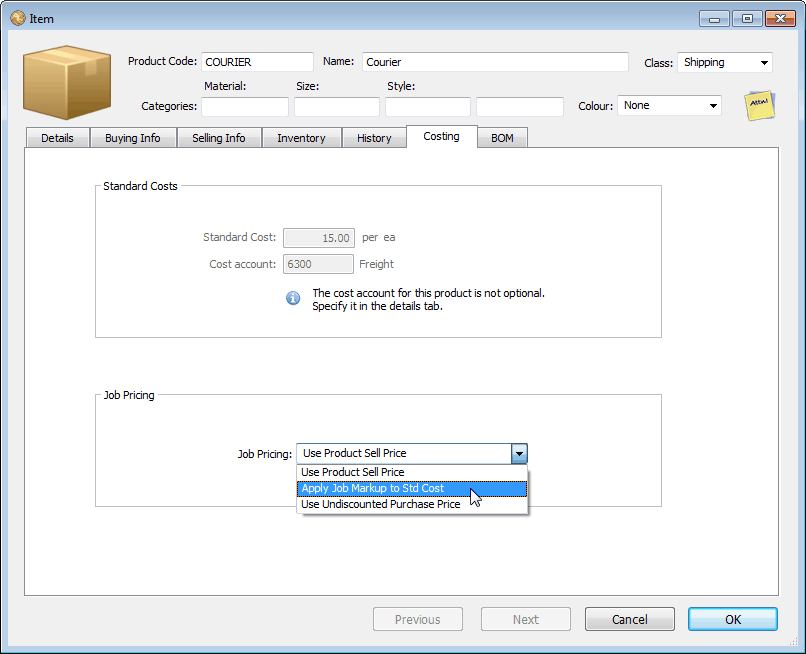

How the costs and markup are calculated for products and resources when the Job Control preference Enable Job Costing and Time Billing is set is determined by the settings in the Costing panel of the Product entry-screen.

The Standard Costs fields relate to costing information, while the Job Pricing pop-up menu is used to determine charges for the item.

Standard Cost: This is the standard cost that will be used in job costing. If the product is purchased the last discounted purchase price of the item is used. For non-purchased items you can specify a “standard cost”. This represents the estimated cost to you of providing the item—determining a standard cost is something of a black art.

Cost Account: This is the cost account for the item for work in progress purposes, which can be specified here for non-purchased items. For purchased items, this will be set to the cost of goods account as specified in the Details tab.

Note: This account is used to create the work in progress journal. If there is no cost account specified then costs associated with this resource will not be considered as work in progress.

Use Product Sell Price: The sell price is that of the sell price in the product file.

If the product is entered into the job sheet file directly, the buy price of the product is used to determine the cost price, and the sell price of the product determines the sell price. If the item is a stocked product, the average unit price is used to determine the cost price (and a stock requisition journal is created).

If the product is entered into a transaction detail line associated with a job, the cost price is the actual price paid as specified in the detail line, even if the product is a stocked item.

Use Job Markup applied to Std Cost: The sell price is determined by applying the standard markup for the job to the cost. The cost is determined in the same manner as in the Use Product Sell Price option.

Use Undiscounted Purchase Price: This only affects products entered through a transaction, and not through the job sheet entry. The product must be purchased and sold, and not a stock item.

Consider the following: Part of the service of an interior decorator is the supply of fabric. Conceivably each possible fabric could be entered as a product, with its own code and price. However with thousands of possible fabrics, each with a different colour, width and price, and with designs being added and discontinued each day, the maintenance of such a product file would be immense. The Use Undiscounted Purchase Price option is designed for this situation.

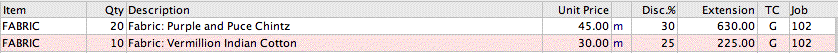

Following on from the example above, a generic product with a code of FABRIC could be used, with no buy or sell price specified (these would vary depending fabric type), with the Job Pricing set to Use Undiscounted Purchase Price. Let’s say we purchase two lots of fabric for job 102. We enter the purchase as either a creditor invoice or a cash payment (depending upon how we paid for it). The detail lines of the transaction will be:

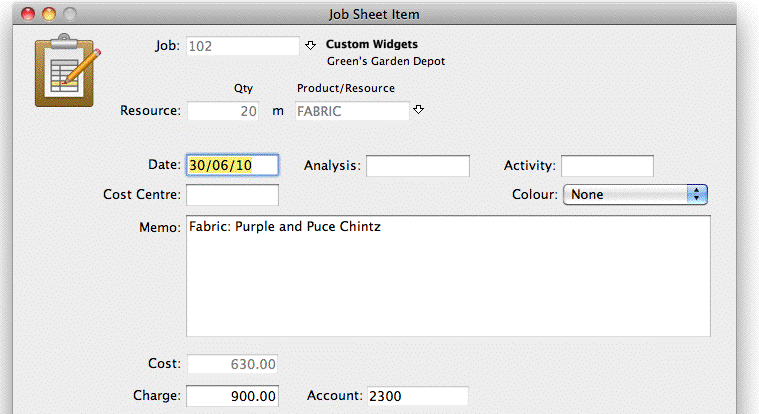

Here we have entered the recommended retail price of the fabric (per unit) into the Unit Price field. This is how much we intend to charge the client for it, and hence this will become the sell price. However we actually pay less than this for the fabric, and we enter the total amount paid (less GST/VAT/Tax) into the extension column. This becomes the cost price of the item. When the transaction is posted, a job sheet item is created, for each detail line. The first of these is shown below.

In summary, when products with Use Undiscounted Purchase Price set are transferred from a transaction to a Job Sheet, the sell price is determined by the UnitPrice x Qty, and the cost is set to the (discounted) Extension.