MoneyWorks Manual

eInvoice Settings

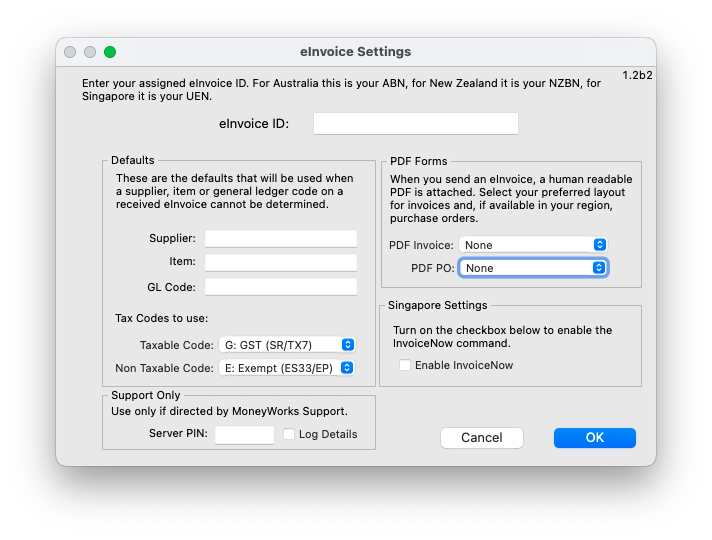

Before you use eInvoicing, you need to set up the eInvoicing settings and defaults in MoneyWorks.

- Choose Command>eInvoice Settings

The MoneyWorks eInvoice Settings window will be displayed.

- Enter your eInvoice ID

This will be your ABN, NZBN, UEN or VAT Number, depending on country. Note that this must be same as the one entered in the eInvoice Sign Up page

- Enter a default item, supplier code and GL Code

If MoneyWorks cannot identify the supplier or item on a supplier invoice, it will substitute these (you will need to check and correct the invoice).

- If you want to include a pdf with the eInvoice, select the invoice form to use from the PDF Invoice pop-up

Leave this at None if you do not wish to include a pdf.

- In jurisdictions that support the transmission of purchase orders, if you want to include a pdf with the order, select the order form to use from the PDF PO pop-up

Leave this at None if you do not wish to include a pdf.

- Select the correct tax codes to use for transaction lines on eInvoices that have GST/VAT and those that don't

MoneyWorks will assign those codes to the lines but will not change the GST amount on the imported invoice.

- For Singapore users only, when you are ready to "embrace" InvoiceNow, turn on the Enable InvoiceNow check box.

Turning this on will add a new InvoiceNow ... command to the Command menu. Use this to start the Invoice initialisation process and to manage InvoiceNow transactions. Note that once turned on, this checkbox cannot be turned off (but it has no other affect than to enable the new menu command). See the InvoiceNow section in the GST chapter.

Leave the Support settings untouched unless requested by MoneyWorks support.