MoneyWorks Manual

Asset Revaluation

Asset can be revalued, normally based on their market value versus the book value (which is the purchase price of the asset less the accumulated depreciation). You should check with your accountant before revaluing assets. MoneyWorks uses the Revaluation Method of revaluing.

To revalue an asset

- Choose Show>Assets

The asset list will be displayed.

- Highlight the asset being revalued

Each asset must be revalued individually.

- Click the Revalue toolbar button

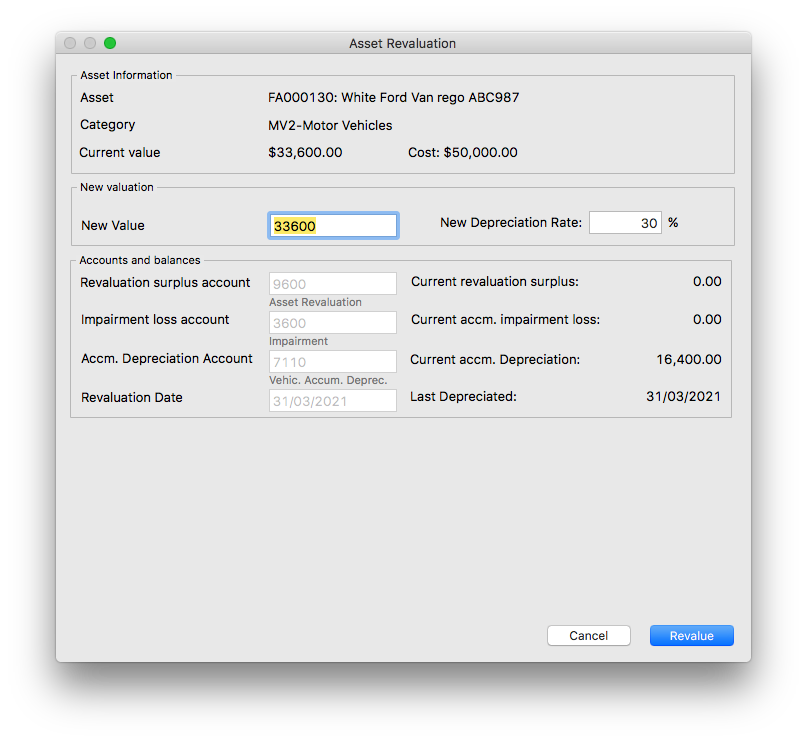

The Asset Revaluation dialog will be displayed

- Set the new depreciation rate

This needs to be recalculated based on the expected remaining life of the asset. MoneyWorks leaves this as an exercise for the user.

- Enter the new value for the asset

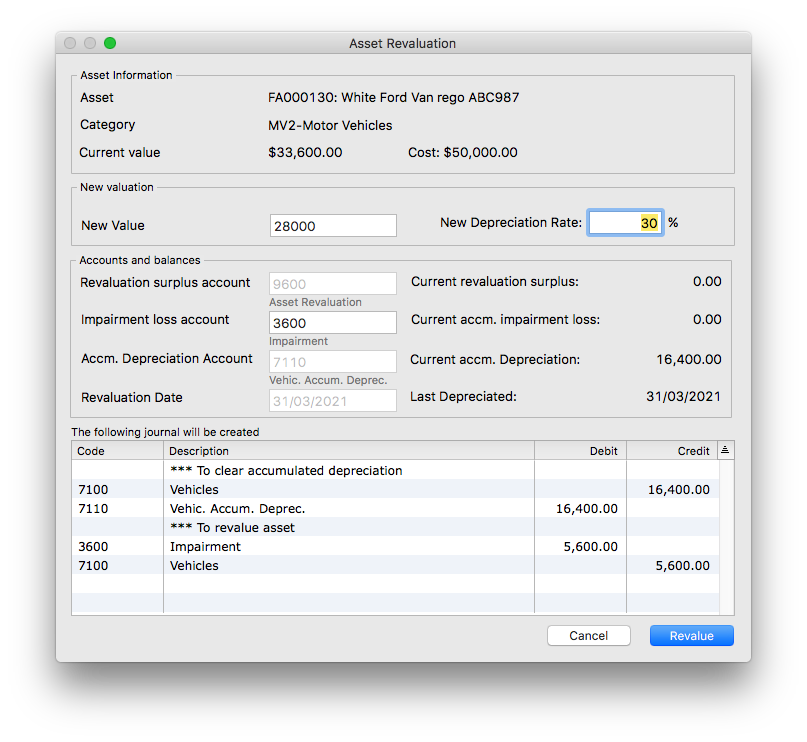

The current book value of the asset will be displayed by default—change this to the new value of the asset. When you tab out the field, and if the value has changed, the proposed journal that will be created is displayed:

The structure of the journal will differ depending on whether the asset is increasing or decreasing in value.

- Change the Revaluation or Impairment account code if necessary

These default to those specified in the asset category.

- Click Revalue to revalue the asset

The asset revaluation journal will be created and posted. The book value of the asset will be the new value specified, and its accumulated depreciation will be set to zero.