If you are an MYOB or AccountEdge user, you may have noticed that it is next to impossible to export your vital accounting information out of your system. For example, export your items list and there is no stock on hand. Export your customer list and there are no balances. This makes it hard for people to migrate from MYOB into a more modern system.

Enter the MoneyWorks MYOB Converter … your “Get out of MYOB Free” Card!

The converter is a free utility that we provide that will (probably) convert your MYOB or AccountEdge data into a MoneyWorks file! Simply run the converter, choose your MYOB (or AE) file, set a couple of parameters, and a new MoneyWorks data file will be created with most of your vital accounting information in it (at least that is the theory). See how easy the process is by watching this five minute video.

- Convert over the General ledger

- Transfer up to six years of financial balances (the limit in MYOB)

- Transfer your card file into the MoneyWorks Names list

- Transfer your items file (including any bills of material) into the MoneyWorks Products list

- Transfer your stock on hand at the average unit value in MYOB

- Transfer your outstanding invoices (as you will need to pay them)

- Transfer your unreconciled payments and receipts

- Transfer outstanding orders and quotes

What you need to do

First off, you will need a copy of MoneyWorks Gold (or the MoneyWorks Gold demo) installed on your computer. If you don’t have MoneyWorks Gold, you can download a trial version. Then simply download and decompress the MoneyWorks Converter application:

MoneyWorks Converter for Mac (6.3 MB – Universal Binary)

MoneyWorks Converter for Windows (15.0 MB)

Note that you can put this anywhere on your computer (it doesn’t need to be in the Applications or Program Files folder). Windows users should keep the MoneyWorks Converter Libs folder, the MoneyWorks Converter Resources folder and the MoneyWorks Converter.exe in the same directory.

Mac users should note that the converter, like MoneyWorks, is a universal binary and will run natively on both M1/M2 and Intel Macs.

Now download and read the MoneyWorks Converter Notes.pdf (about 1.7Mb).

Then:

- Make sure that there is NO open file in MoneyWorks (MoneyWorks can be running, but with no file open).

- Start the Converter. You will be presented with a file open dialog box — select your MYOB/AE data file. If the Converter can’t see your MYOB/AE file for some reason, change the file’s name to end in .myo (e.g. from “Accounts” to “Accounts.myo”). Note that the MYOB/AE data file must be on your local hard drive, not in a shared or mapped drive, and for Mac users should be somewhere in the Documents folder hierarchy.

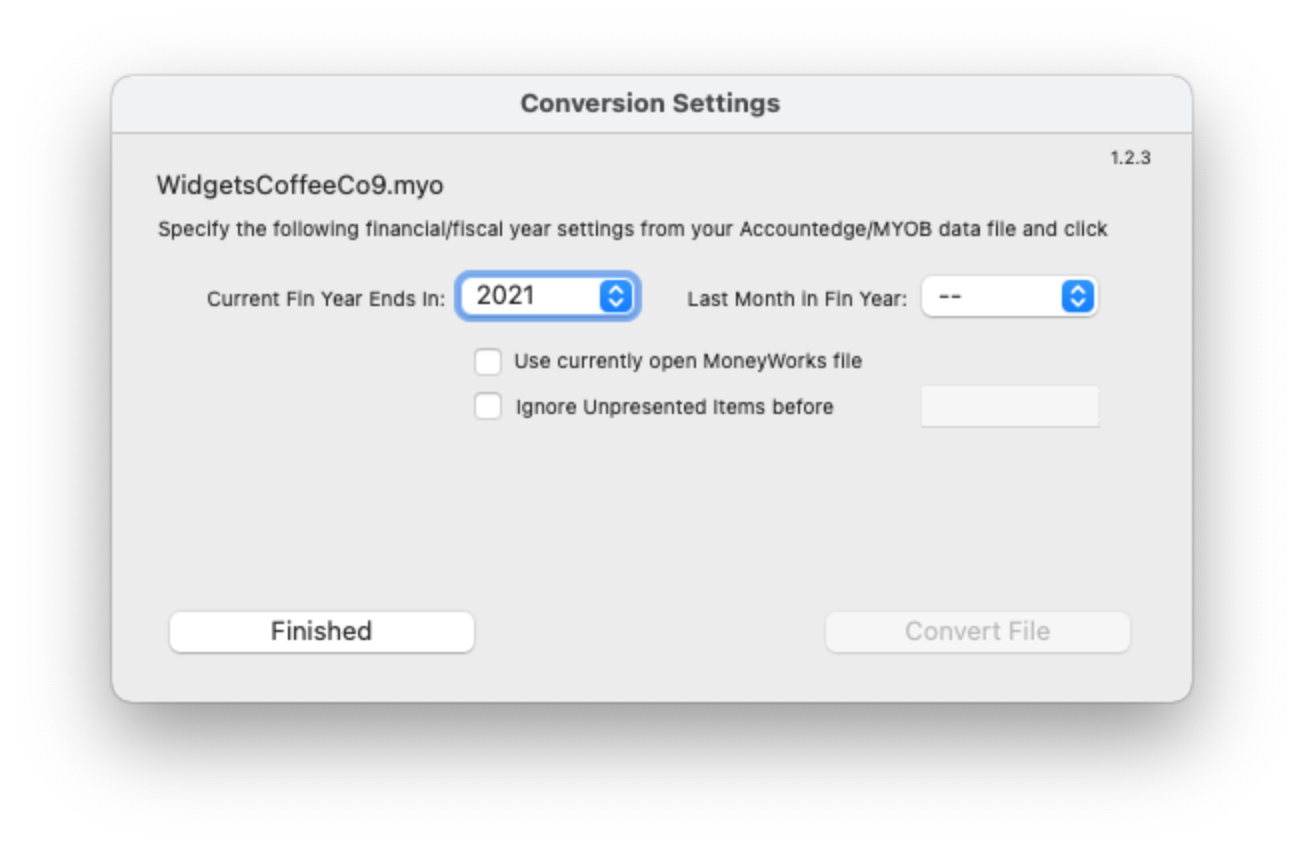

- In the window that then opens, you need to specify (i) the current year that MYOB is operating in, and (ii) the last month of the financial year. Then click the Convert File button.

- The Converter will then read the appropriate data out of your MYOB file and send it to MoneyWorks. MoneyWorks will come to front (possibly hiding the Converter window — if MoneyWorks wasn’t running, you should see it start). It will also open and close the file twice, and the whole process may take a few minutes, depending on the size of your data file. Do not be tempted to interact with the MoneyWorks file while the conversion is in progress — the Converter is using MoneyWorks Automation, a powerful part of MoneyWorks that lets it interchange data with other systems, to send data into MoneyWorks.

- When the Converter has finished (you will know because it will say “Finished” — if necessary bring the Converter to the front by clicking its icon in the dock), and assuming that nothing has gone wrong, you will be able flick into MoneyWorks and you should see your data there.

- You should run off a Balance sheet (or trial balance) from MoneyWorks (under Reports>Balance Sheet) for the most recent period, being sure to click the “Include Unposted” option, and compare the results with that of MYOB (the balance sheet layout is a bit different, so you will need to match up the numbers and tick each one off, ignoring the subtotals in the MYOB report).

- If you used Multi-Currency in MYOB, you will need to manually set up those currencies in MoneyWorks (and set the exchange rate to whatever it was set to in MYOB), and use the Funds Transfer command to transfer the bank balances from the old accounts to the new MoneyWorks forex accounts.

- Finally you should enter the appropriate information into the Company Details (under the Show menu) screen in MoneyWorks.

And that in theory is all you need to do. You might at some point want to tidy up your chart of accounts to take advantage of the more powerful concepts available in MoneyWorks.

For more detailed instructions, please download the MoneyWorks Converter Notes.pdf (about 1.3MB).

We need your feedback!

If you have used the Converter we would like to hear from you, whether it worked or not. Please let us know how you got on by emailing info at cognito.co.nz.

MoneyWorks Converter FAQs

Absolutely not. It is provided on a “best endeavours” basis — it works for us but may not work for you. In particular there can be so many odd things in an MYOB data file that MoneyWorks just will not let happen, and this may thwart you.

What versions of MYOB or AccountEdge does it work on?

Any version from about 2004 up to and including AccountEdge 2019 and MYOB v19.x. There are a plethora of versions (different for every year and country), and we have tried it with Canadian, US, UK, Australian and New Zealand. In principle it should work for any jurisdiction. Note that it will not work on FirstEdge or BusinessBasics files.

It will not work on any versions of AccountRight that use the new database format. This appears to be AccountRight 2012 and later.

My MYOB file has heaps of rubbish in the cards and items file. Should I tidy this up first?

Try just sending it through to MoneyWorks. Maintaining your products and names information in MoneyWorks is much, much easier than in MYOB (for example, you can batch delete).

Where does the MoneyWorks file get created?

It will get created in the same directory as your MYOB file, and will have the same name (but a file extension of .moneyworks).

What if I need to do it again?

No trouble — just run it again (but remember that the previous MoneyWorks file will be over-written, so move it or change its name if you want to keep it for some reason).

Why are some of the products in MoneyWorks showing in Red?

The Converter detected that you had dodgy linked account codes (such as a bank account instead of a cost of sales account), so has replaced the code with something more sensible.

Why are some of the accounts and transactions in MoneyWorks showing in Green?

The Converter detected that these involved a foreign currency. The currency handling under MYOB and MoneyWorks is done differently. You will need to add the appropriate currencies into MoneyWorks (at the last exchange rate used in MYOB), and modify the transactions (they are in the dollar value of the foreign currency, not your local currency). For information on multiple currencies in MoneyWorks please refer to the MoneyWorks Manual.

We’re often asked why we don’t include a payroll module with MoneyWorks. There are a number of very good reasons why:

- Unlike accounting, payroll is different in every jurisdiction. Thus the payroll that works in Sydney will not be any use in Seattle;

- Different organisations have different payroll requirements, so not having a payroll built in means that you can choose the payroll that best suits your requirements;

- Payroll systems are high support, requiring updates whenever a tax change comes along, which in turns necessitates some sort of annual support fee;

- By not providing payroll, we are able to focus on what we do extremely well (continue to develop MoneyWorks);

- A payroll system will normally generate one payroll transaction per pay cycle, so the benefits of tight integration with your accounting system are questionable.

So with MoneyWorks you are free to choose the payroll that best suits your business. That said, the ones listed below are good starting points—they are all cross-platform (run on Mac and Windows), developed and maintained by professional payroll companies, and interface with MoneyWorks in some form. However if these don’t suit, find another that best meets your special requirements.

Australia

CloudPayroll

SmoothPayGold

New Zealand

iPayroll

SmoothPayGold

Canada

CheckMark Payroll

USA

CheckMark Payroll

Papua New Guinea

SmoothPayGold

Solomon Islands

SmoothPayGold

Samoa

SmoothPayGold

American Samoa

SmoothPayGold

Tonga

SmoothPayGold

Fiji

SmoothPayGold

Cook Islands

SmoothPayGold

You’ll just have to live with these, as there is no way that future periods can be closed. However provided you are using version 3 of MoneyWorks or CashWorks these should not cause any inconvenience, as the default period for most operations is determined by the current date.

If you are using an older version, the period wil often default to the last period opened, so you need to be vigilant when entering transactions, cancelling and so forth.

You will not be able to enter into a period if it is locked or closed (check using the Open/Close period command in the Command menu). If the period is locked, you need merely unlock it. If the period is closed, you will not be able to open it again, and hence will not be able to enter the transaction into that period (after all, that is why periods can be closed).

In version 2 of MoneyWorks and CashWorks, you could not enter into a period if the Display filter in the Transaction List window is set to not display that period. This restriction was removed in version 3.

The most likely reason that you cannot close a period is because there are unposted transactions in the period. You need to post (or delete) these transactions.

The easiest way to find these is to go into your Unposted view (the View by Status view in the Transactions list window) and click on the Period heading to sort it by period.

The GST Guide is always based on the last finalised GST results. This simply means that you haven’t finalised the GST report for this cycle — so redo the report and finalise it, then redo the GST Guide.