It is not uncommon for not for profits (such as sporting clubs, schools, charities) to get some sort of grant from a parent or government body, and need to monitor or report on how the funds were allocated. Similarly the organisation might run an event, and want to track its profitability.

This can be easily done in MoneyWorks by using Job Tagging, a feature that is available in all MoneyWorks products (even MoneyWorks Cashbook). Basically this provides an additional column in the transaction entry window for a job code, allowing you to tag relevant income and expenses to a job, which represents the grant or event.

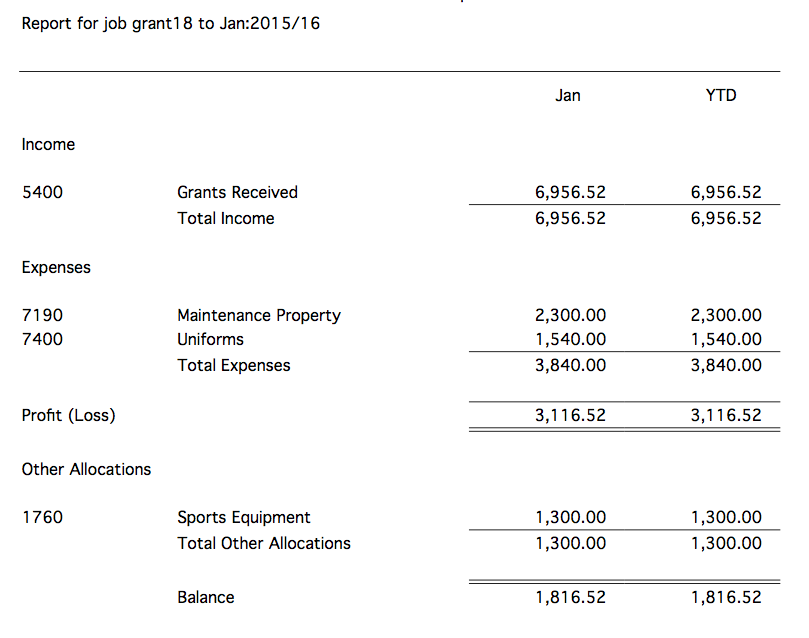

The job allocations can then be summarised in one of the Job Tagging reports.

If you haven’t used jobs before, you need to turn Job Tagging on under Edit>Document Preferences>Jobs and turn on the Show Job Column in Transaction Entry option.

If you are using MoneyWorks Express and Gold, you can turn off the Allow any value in job column option. This means you can create a”Job” for the grant/event, and MoneyWorks will be able to validate that you are entering a valid job code (which you can’t do in Cashbook). To create a job choose Show>Jobs and click the New toolbar button. Note that each job requires a client code (on the assumption that you are going to raise an invoice for the job): in this instance you should assign the job to yourself by setting yourself up as a customer (debtor).

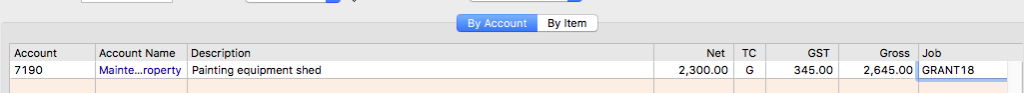

Whenever you receive a grant (or income for an event), you can enter the code into the job column of the transaction. Similarly when you spend money from the grant (or on an expense for the event), you record the job code on the expense line. The status of the grant (or profitability of the event) can then be seen in the Job Allocation report (new in MoneyWorks 8.1.5):