On 1st January 2023 there is both a GST rate increase to 8%, and new reporting requirements for GST. A further rate increase to 9% is set for 1st January 2024.

For details on handling the rate increase see Changing VAT and GST Rates in MoneyWorks. But also be aware that there are transition rules that need to be followed.

The new reporting requirements, which incorporate a reverse charge tax, are available in MoneyWorks 9.1.1. The F5 form and IRAS Connect require the use of the following tax codes to fill the designated boxes.

| Box 14: Did you import services subject to GST under Reverse Charge? | |

| LVRC | A Reverse Tax which applies the claimable amount of the service only, and should only be used on purchase transactions. |

| LVRC- | This applies to the non-claimable amount of the service, and should be set up as a normal GST tax at 0%. |

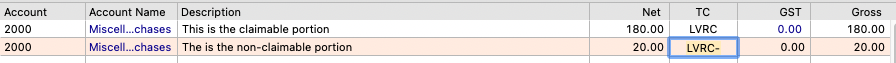

Thus a purchase of a $200 service under reverse charge where 90% is claimable would be entered as: |

|

| Box 15: Did you operate an electronic marketplace to supply remote services subject to GST on behalf of third-party suppliers? | |

| EMREM | This is a normal GST code set up for 8% GST on or after 1st January 2023. It should only be used on sales transaction. |

| Box 16: Are you a redeliverer or electronic marketplace operator supplying imported low-value goods that is subject to GST? | |

| LVRED | This is a normal GST code set up for 8% GST on or after 1st January 2023. It should only be used on sales transaction. |

| Box 17: Did you supply imported low-value goods that is subject to GST? | |

| LVOWN | This is a normal GST code set up for 8% GST on or after 1st January 2023. It should only be used on sales transaction. |

| The net of transaction lines that use any of the above codes is also included in Box 1 | |

You will need to set up these codes (under Show>Tax Rates) manually if you are affected by these new reporting requirements and your file was created in a version of MoneyWorks earlier than 9.1.1. Be sure to set LVRC as a Reversed Tax, and not to GST or VAT.