There is currently talk in a number of countries of governments reducing the VAT or GST rates for at least a short time to give their economies a boost to help counter the economic impact of the Covid-19 pandemic.

If this happens in your locale, here’s what you need to do in MoneyWorks.

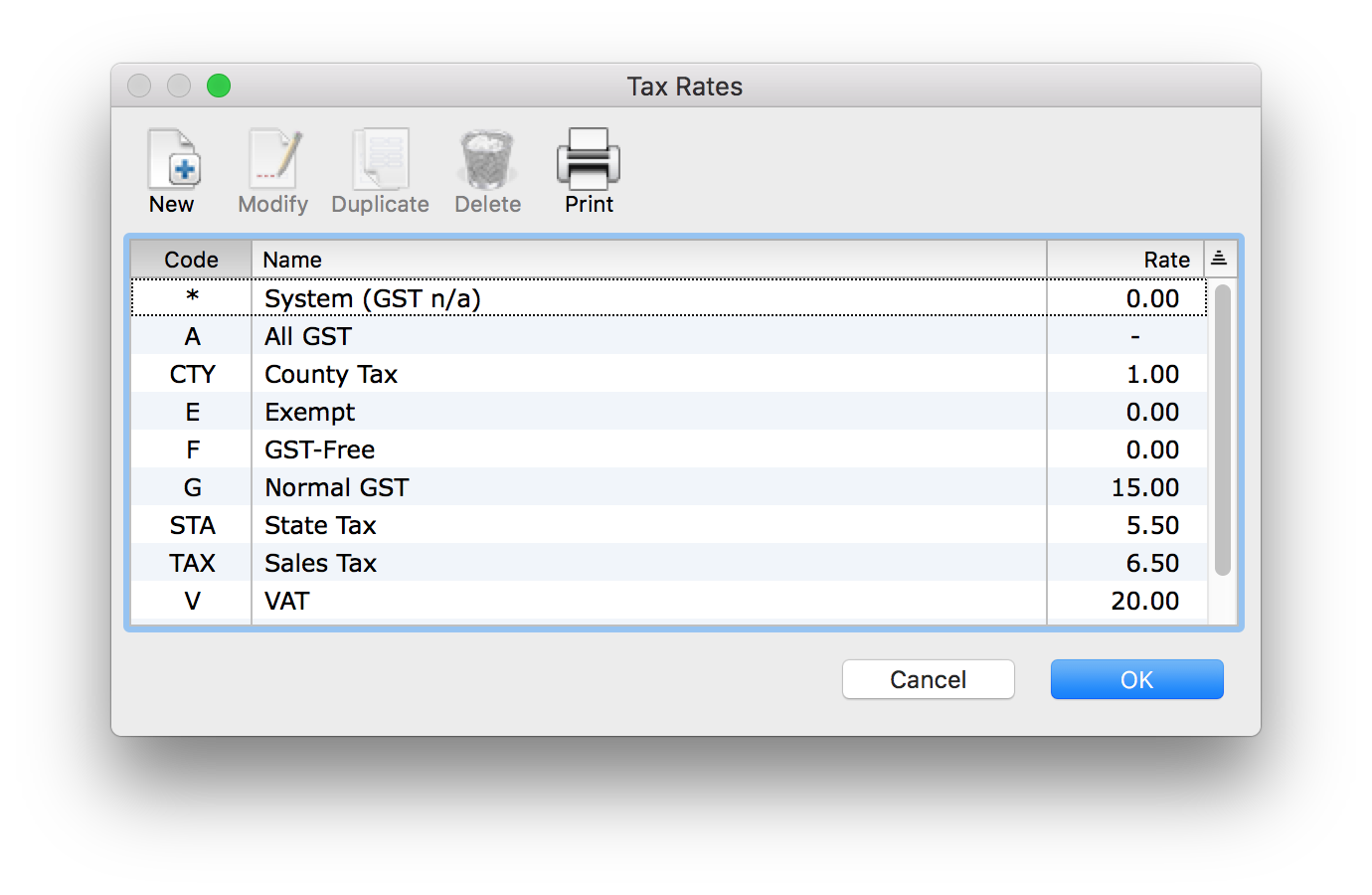

1. Go to your Tax table by choosing Show>Tax Rates

The Tax Rates list will be displayed.

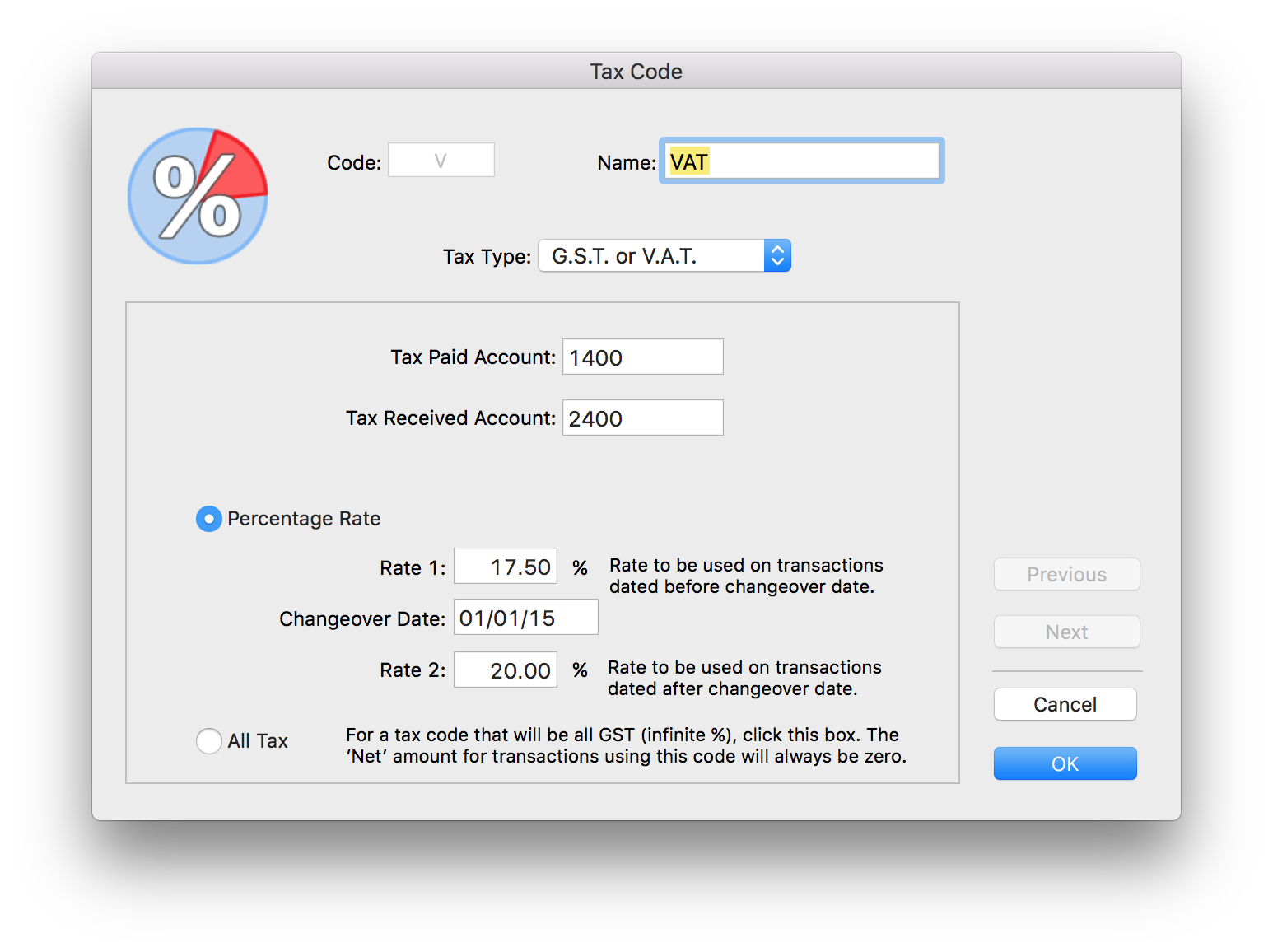

2. Double-click the affected tax code(s)

The Tax Code window will be displayed.

There are two tax rates displayed along with a changeover date. Rate1 applies to transactions dated before the changeover date, and Rate2 applies to those after.

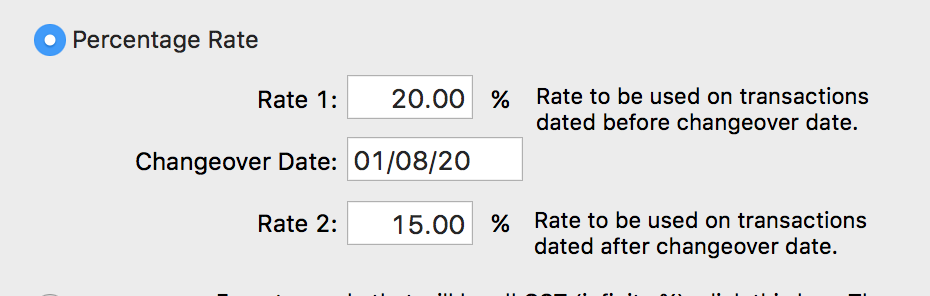

Let’s assume that the UK Government reduces the VAT rate to 15% on 1st August 2020. To achieve this in MoneyWorks:

3. Change the Rate 1 to the current rate (20%)

4. Set the changeover date to 1st August 2020

5. Set Rate 2 to the new rate (15%)

Transactions dated before 1st August will continue to have VAT applied at the 20% rate. Transaction dated on or after this date will have VAT applied at the new rate of 15%. This means you can set up the new rates some time in advance of the actual changeover.

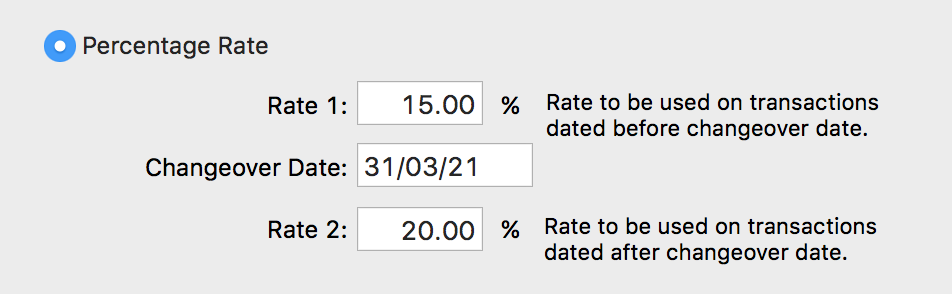

Oddly, downwards tax changes seem to always be temporary, so at some time the rate will return to normal. Let’s say the rate will return to 20% on 31st March 2021. At some point before 31st March, you would need to reset the rates. But you can only do this once you have entered and posted all the transactions dated prior to the first rate change (i.e. 1st August 2020).

6. In the Tax Code window, set Rate 1 to 15%, set the changeover date to 31st March 2021, and set Rate 2 to 20%.

Of course doubtless there will be special forms that you need to complete, but from a MoneyWorks perspective, that is all you need to do.

Caveat on Recurring Transactions

Recurring transactions, being copies of the original, may recur with the old tax rates. You should check the newly recurred transactions before you post them and, if the rate is wrong, update it by rekeying the tax code on each line of the transaction. Subsequent recurrals (a necessary neologism) will be based on this modified transaction.